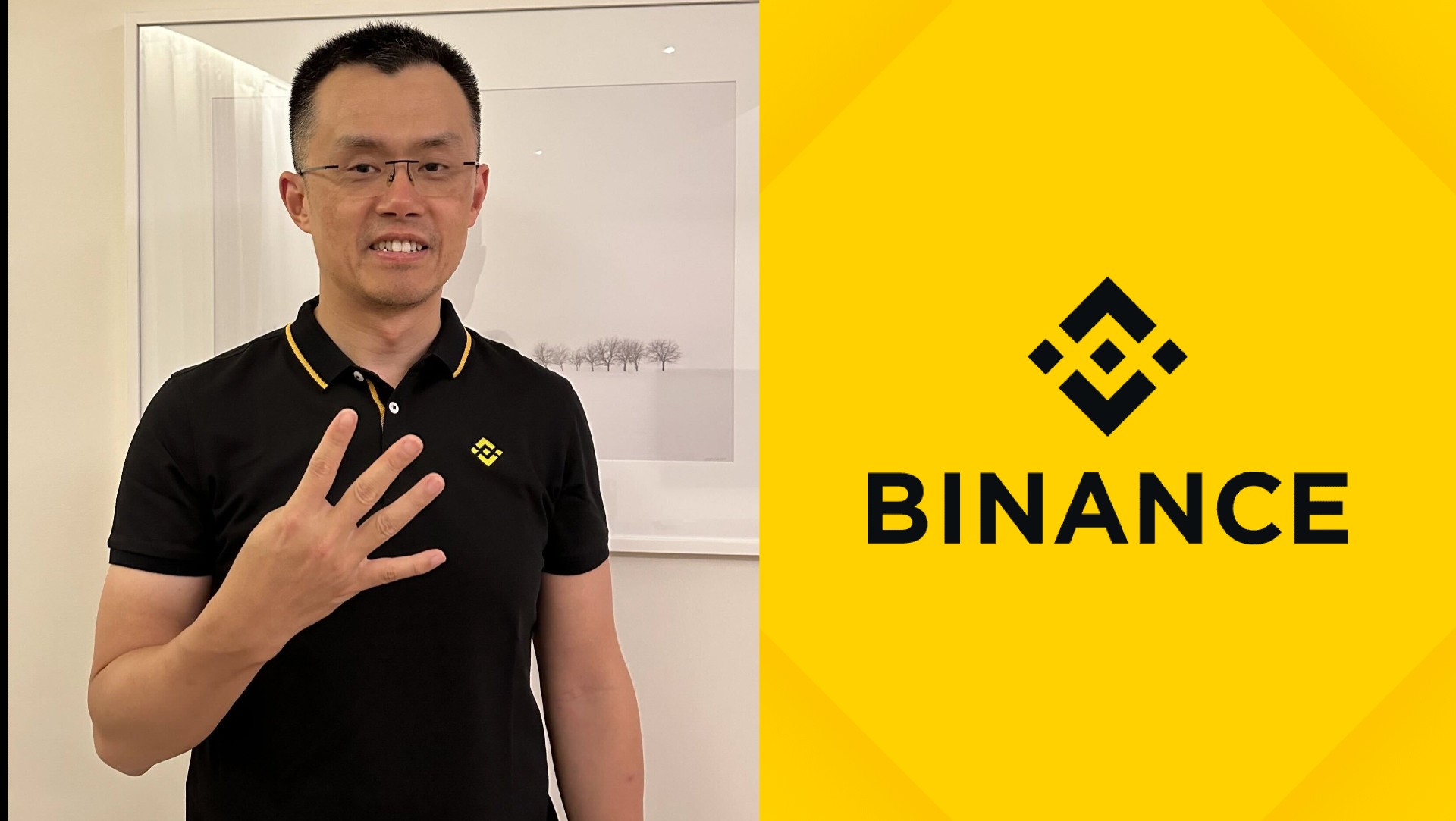

Binance’s Former CEO, Changpeng Zhao, to Step Down Amidst $4.3 Billion Settlement with U.S. Department of Justice

In a groundbreaking move, Binance, the world’s largest cryptocurrency exchange, has agreed to pay a staggering $4.3 billion to settle an investigation by the U.S. Department of Justice (DOJ) into its anti-money laundering (AML) and know-your-customer (KYC) practices. As part of the settlement, Changpeng Zhao (CZ), Binance’s founder and former CEO, will also step down from his position.

The DOJ’s investigation revealed that Binance had failed to implement adequate AML and KYC procedures, allowing criminals to use the platform to launder money and evade sanctions. This failure to comply with U.S. law had significant consequences, as it enabled illicit actors to exploit the cryptocurrency market for their nefarious purposes.

In addition to the financial penalties, Binance has also agreed to forfeit an additional $2.5 billion in assets and to implement a comprehensive set of remedial measures to strengthen its AML and KYC programs. These measures include hiring more compliance staff, enhancing customer verification procedures, and conducting ongoing risk assessments.

The settlement with Binance represents a major victory for the DOJ in its ongoing efforts to combat illicit activity in the cryptocurrency sector. It also sends a strong message to other cryptocurrency exchanges that they must comply with U.S. law in order to operate legally in the country.

The Implications of the Settlement

The settlement with Binance has far-reaching implications for the cryptocurrency industry as a whole. It is likely to lead to increased scrutiny of other cryptocurrency exchanges and a greater focus on AML and KYC compliance. It may also prompt some exchanges to reconsider their business models, particularly those that have been operating in regulatory gray areas.

The settlement is also likely to have a significant impact on Binance itself. The financial penalties will undoubtedly strain the company’s resources, and the loss of CZ, a charismatic and influential figure, could damage its reputation. However, the company has expressed its commitment to cooperating with the DOJ and implementing the necessary reforms.

The Future of Binance

It remains to be seen whether Binance can successfully overcome the challenges it faces and emerge stronger from this ordeal. The company’s future will depend on its ability to address the regulatory concerns that have been raised and to rebuild trust among its users.

The settlement with Binance is a watershed moment in the history of cryptocurrency. It is a clear signal that the U.S. government is serious about cracking down on illicit activity in the cryptocurrency sector. It is also a reminder that cryptocurrency exchanges are not above the law and must adhere to the same regulatory standards as other financial institutions.

The cryptocurrency industry is still in its early stages of development, and it is inevitable that there will be regulatory challenges along the way. However, the settlement with Binance is a step in the right direction towards ensuring that the cryptocurrency market operates in a safe, transparent, and compliant manner.

No related posts.