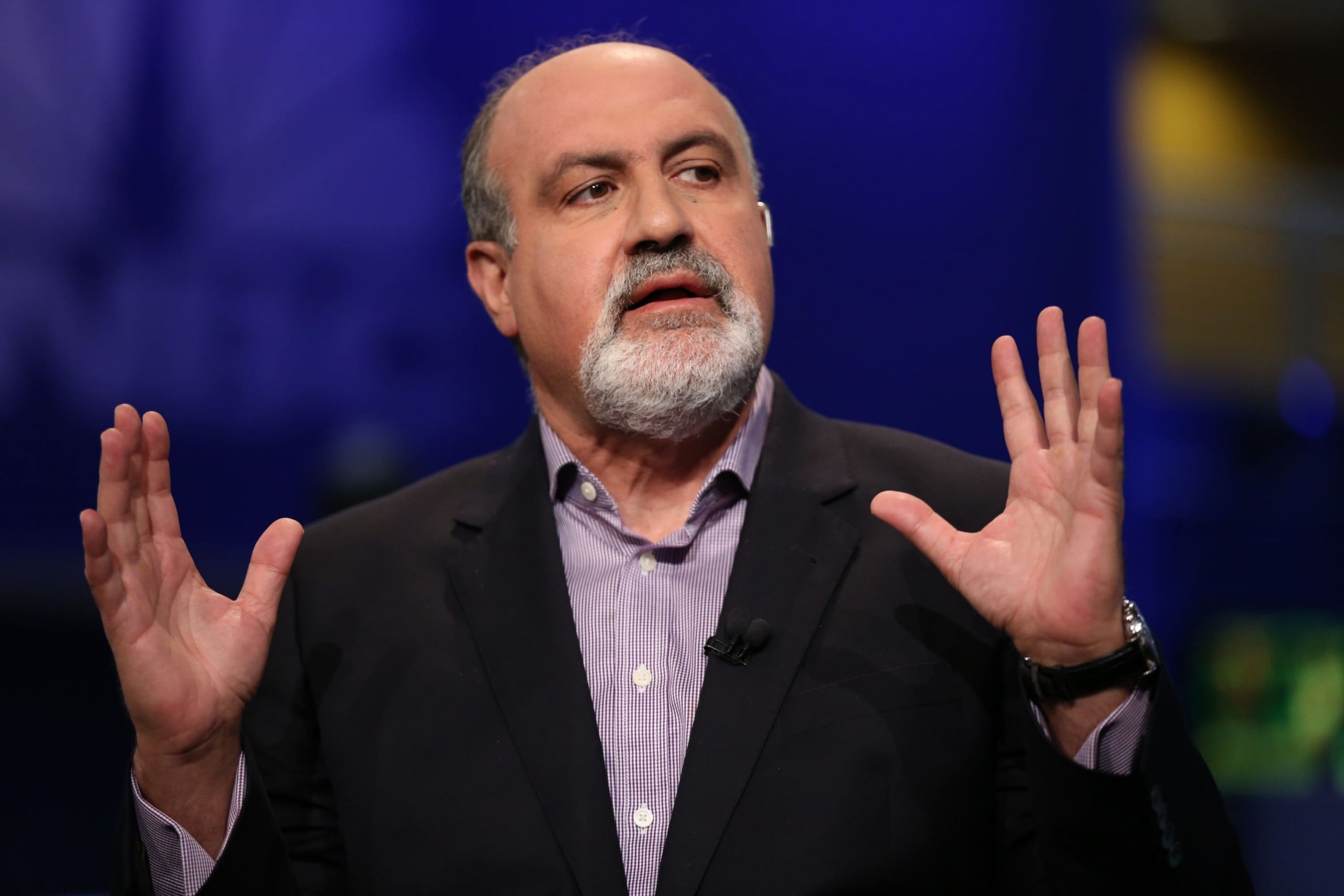

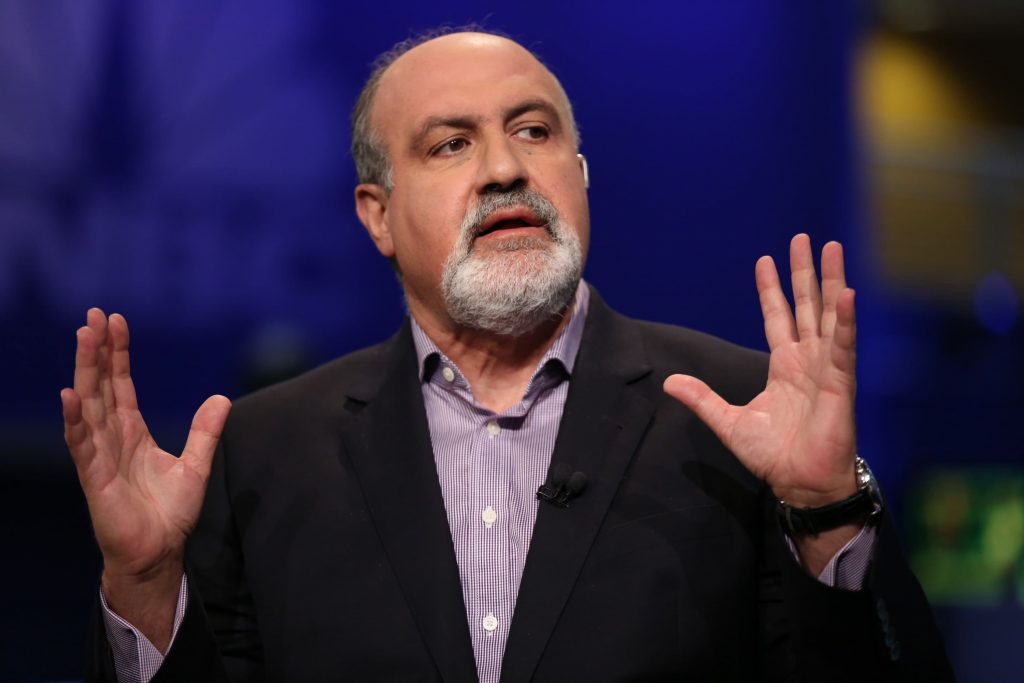

‘Black Swan’ author calls bitcoin a ‘gimmick’ and a ‘game,’ says it resembles a Ponzi scheme

‘Fundamentally, there is no link between inflation and also bitcoin. None. I mean you can possess hyperinflation and bitcoin moving to zero.

‘it is a superbly setup cryptographic system. It is well made but there is simply no reason it needs to be connected to whatever economical,’ additional Taleb, whose best-selling 2007 publication analyzed highly unlikely events and their capacity to cause serious consequences. He explained bitcoin has attributes of what he calls that a Ponzi scheme that is right outside in the start.

A Ponzi scheme is a kind of fraud where crooks steal cash from shareholders and conceal the thieving by funneling yields to customers from capital contributed by investors that are newer.

Taleb had formerly held positive opinions supporting bitcoin, that was made in 2009 and will be the world’s biggest cryptocurrency by market worth. But he told CNBC that he had been’duped by it originally’ since he believed it might become a money used in trades.

‘Something that goes 5% every day, 20 percent per month – upward or down – can’t be a money.

‘I purchased it… not prepared to get capital admiration, so long as needing to have an Alternate to the fiat money issued by central banksA money with no government,’ Taleb said’ I understood it wasn’t a money with no government. It was only pure speculation. It is exactly like a match… I mean, it is possible to make a second sport and call it a money.’

When some companies do accept bitcoin as payment of products and services, such as electrical car manufacturer Tesla, you will find those from the crypto community that believe it is really an advantage and store of value. Bitcoin, that has its own source capped in 21 million tokens, was described as’digital stone ‘

‘It is easily transportable and could be shipped anywhere in the world when you’ve got a smartphone so that it’s a far superior variant, as a store of valuethan gold,” famous value investor Bill Miller informed CNBC earlier that week.

‘Together with bitcoin, volatility is the price that you pay for functionality,’ additional Miller, who’s previously claimed bitcoin develops less insecure as adoption and its own cost increases.

Really, the purchase price of bitcoin has surged higher lately – climbing from below $11,000 percent as recently as October into a all-time large of almost $65,000 final week. Increased systemic adoption continues to be mentioned as one variable in its growth .

On the other hand, the cost has risen over 70% year so far, based on Coindesk.

Taleb indicated bitcoin’s cost isn’t what advises his now-critical perspective, stating’bitcoin could visit $1 million’ and it would not alter his debate. ‘All these gimmicks, you’ve got bitcoin now. You might have another 1 tomorrow.

Investors that are concerned about inflation could be much better off buying house than buying bitcoin, Taleb said. ‘If you would like to hedge against inflation, then purchase a parcel of property. Grow, I do not understand, olives onto it. In the event the purchase price collapses, you will have something’

‘However bitcoin, there is no link and, needless to say, the very best way for investors would be to own items that make yields later on. To put it differently, it is possible to fall back on actual dollars coming from the business,’ he explained.

No related posts.